Meydan Free Zone FAQ—This 2025 expert guide answers the most common questions about business setup, licensing, costs, visas, and compliance in Dubai’s Meydan Free Zone. Whether you’re a startup, SME, or foreign investor, find authoritative, up-to-date answers here.

Table of Contents

1. What is Meydan Free Zone and where is it located?

Meydan Free Zone is a leading business hub in Dubai, UAE, offering 100% foreign ownership, digital company formation, and a strategic location just minutes from Downtown Dubai and Dubai International Airport. Learn more at the official Meydan Free Zone site.

2. What types of businesses can I set up in Meydan Free Zone?

You can set up commercial, consultancy, e-commerce, media, general trading, holding, professional, and industrial businesses. The free zone supports over 2,000 licensed activities. See the full activity list here.

3. How do I start a business in Meydan Free Zone?

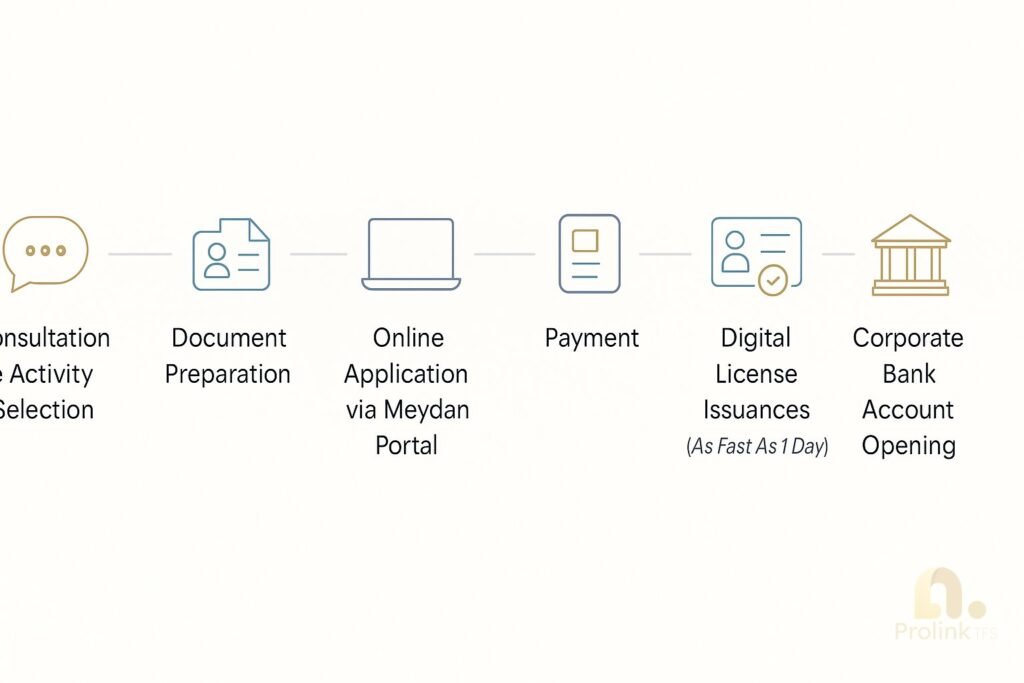

The process is fully digital: choose your activity, prepare documents, apply online, pay fees, and receive your license. For a detailed, illustrated process, see below.

4. How much does a Meydan Free Zone license cost in 2025?

License packages start from AED 12,500–14,500 (subject to change; government fees may vary). Multi-year packages and visa allocations affect the cost. Get an exact quote from Prolink TFS.

5. What documents are required for Meydan Free Zone company formation?

You’ll need a passport, passport photo, proof of address, and a business plan for some activities. Prolink TFS provides a full checklist and assists with document preparation.

6. How long does it take to get a Meydan Free Zone license?

You can receive a digital license in as little as 1 business day after submitting your documents and payment. The full process—including visa issuance—typically takes 1–3 days.

7. Can I get 100% foreign ownership in Meydan Free Zone?

Yes, Meydan Free Zone allows 100% foreign ownership for all company types and activities.

8. How many visas can I get with my Meydan license?

Depending on your package, you can allocate from 0 up to 6 visas per license. Visa costs and limits depend on your chosen package and business activity.

9. Is Meydan Free Zone good for e-commerce and consulting?

Absolutely. Meydan is highly popular with e-commerce brands, digital startups, remote consultants, and tech companies due to its digital setup and flexible licensing.

10. What are the benefits of setting up a company in Meydan Free Zone Dubai?

Meydan offers a strategic location, fast digital setup, 100% foreign ownership, competitive pricing, and access to a business-friendly ecosystem. Compare with other Dubai free zones here.

11. What are the annual renewal requirements?

You must renew your license annually, submit audited financials (from 2025), and ensure your business activity and visa allocations are up to date. See Meydan’s official renewal guidelines.

12. Do I need audited financials for renewal in 2025?

Yes. From 2025, all Meydan companies must submit audited financial statements for license renewal, regardless of visa allocation. Read about the audit requirement.

13. How does Meydan Free Zone compare to IFZA, SPC, and DMCC?

Here’s a quick comparison:

Comparison of top Dubai free zones – Meydan, IFZA, SPC, DMCC (2025) Alt text: Comparison of top Dubai free zones – Meydan, IFZA, SPC, DMCC (2025)

| Free Zone | License Cost (AED) | Setup Time | Visa Limit | Ideal For |

|---|---|---|---|---|

| Meydan | 12,500–14,500 | 1–3 days | Fixed to office Space leased | E-commerce, consulting, SMEs |

| IFZA | 12,900–14,900 | 3–10 days | Up to 10 | Startups, digital firms |

| SPC | 9,000–12,000 | 1–3 days | Fixed to office Space leased | Freelancers, service firms |

| DMCC | From 24,000+ | 2–4 weeks | Varies | Global trade, commodities |

For a detailed breakdown, visit our IFZA and SPC.

Want to compare all business setup options in Dubai? Read our Business Setup in Dubai pillar guide or our Mainland vs Free Zone Company Formation comparison.

14. Is Meydan Free Zone better than IFZA or SPC for startups?

Meydan, IFZA, and SPC are all excellent for startups. Meydan stands out for its digital process and central Dubai location, while IFZA and SPC are also digital and offer competitive pricing and strong support for digital businesses and freelancers. In short they all are great but it would be dependant on which free zone can accommodate your business needs.

15. What are the banking options for Meydan Free Zone companies?

Popular banks include Wio Bank, Mashreq NeoBiz, RAKBank Business, and Emirates NBD. Bank account approval is subject to compliance and due diligence.

UAE corporate banking options for Meydan Free Zone companies Alt text: UAE corporate banking options for Meydan Free Zone companies

16. What is the process for opening a corporate bank account?

After company setup, Prolink TFS assists with introductions to banks. You’ll need your license, incorporation documents, and KYC paperwork. Each bank has its own compliance checks. See our step-by-step banking guide.

17. Is Meydan Free Zone tax-free? What about UAE corporate tax?

Meydan companies are subject to the UAE’s 9% corporate tax. However, Qualifying Free Zone Persons (QFZP) may be exempt if income is from permitted activities and non-mainland transactions. Read about UAE corporate tax.

18. How can Prolink TFS help me set up in Meydan Free Zone?

Prolink TFS offers end-to-end support: consultation, document preparation, application management, visa processing, banking introductions, and ongoing compliance. Book your free consultation now.

Ready to Launch your Business in Meydan?

Ready to launch your Meydan Free Zone company? Book a free consultation with Prolink TFS. Our experts handle everything — from choosing the right package to assisting with opening your UAE bank account. Contact us today.

References & Internal Links

- Meydan Free Zone Official FAQ

- Meydan Activity List

- Mainland vs Free Zone UAE

- Business Setup in Dubai

- IFZA Free Zone Company Formation Guide

- Set up a company in SPC Free Zone (2025 guide)

- Corporate Tax in UAE: What You Need to Know

- Wio Bank

- Mashreq NeoBiz

- RAKBank Business

- Emirates NBD Business Banking

Disclaimer

This FAQ is for informational purposes only and does not constitute legal or tax advice. Always consult with a qualified advisor or the relevant authority for the latest requirements and regulations. Information is accurate as of October 2025, but government fees and rules may change.