Table of Contents

Executive Summary

Meydan Free Zone is one of Dubai’s most dynamic business hubs for 2025, offering entrepreneurs and SMEs a fast, flexible, and fully digital company formation process. With over 2,000 business activities, affordable license packages, and a strategic location, Meydan is ideal for e-commerce, consulting, and tech startups. This guide covers everything you need to know about forming a company in Meydan Free Zone, including costs, process, compliance, and how Prolink TFS can help you launch with confidence.

Key Facts: Meydan Free Zone at a Glance

- Location: Dubai, UAE (Official site)

- Business Activities: 2,000+ (commercial, consultancy, media, e-commerce, general trading, holding, professional, industrial)

- Ownership: 100% foreign ownership

- License Packages: From AED 12,500–14,500 (subject to change; government fees may vary)

- Visa Options: 0–6 visas per license

- Setup Time: As fast as 1 day (digital license)

- Bank Account Support: Wio, Mashreq NeoBiz, RAKBank Business, etc.

- Audit Requirement: Audited financials required for all renewals from 2025 (see Meydan Audit Guidelines)

- Corporate Tax: 9% (exemptions for Qualifying Free Zone Persons – Article 18 CT Law)

Why Meydan Free Zone Stands Out in 2025

- Strategic Location: Minutes from Downtown Dubai and Dubai International Airport.

- Digital-First: 100% online setup, document upload, and license issuance.

- Business Community: Join 10,000+ companies across tech, trading, consulting, and e-commerce.

- Flexible Packages: Zero-visa, flexi-desk, and multi-visa options.

- Cost-Effective: Highly competitive license pricing and renewal fees.

- Registered Meydan Channel Partner: Prolink TFS is a trusted, registered partner with experience in Expat business setup globally and assistance with relocation service to the UAE

Meydan vs IFZA vs SPC vs DMCC: Free Zone Comparison Table

| Feature | Meydan Free Zone | IFZA | SPC Free Zone | DMCC |

|---|---|---|---|---|

| Ownership | 100% foreign | 100% foreign | 100% foreign | 100% foreign |

| Visa Limits | 0–6 | 0–6 | 0–6 | 0–6+ |

| License Renewal Cost | AED 12,500–14,500 | AED 12,900–14,900 | AED 6,500–12,000 | AED 13,000+ |

| Setup Time | 1–3 days (digital) | 2–5 days | 2–4 days | 3–7 days |

| Banking Ease | Wio, Mashreq NeoBiz, RAKBank, Emirates NBD | Mashreq NeoBiz, Wio, FAB, RAKBank | Mashreq NeoBiz, Wio, RAKBank | Emirates NBD, Mashreq, FAB |

| E-commerce Ready | Yes | Yes | Yes | Yes |

| Best For | E-commerce, consulting, tech startups | General trading, holding, consulting | Startups, freelancers, SMEs | Commodities, global trading |

| Audit Required | Yes (2025 onward) | Yes (2025 onward) | Yes (2025 onward) | Yes (2025 onward) |

| Official Link | Meydan | IFZA | SPC | DMCC |

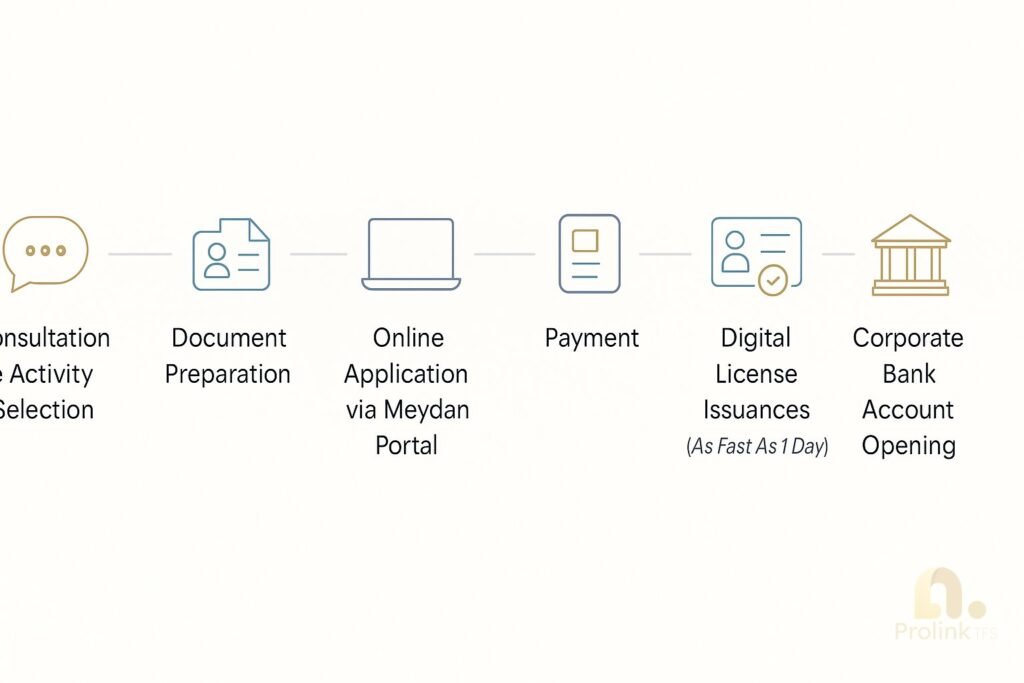

Step-by-Step: Meydan Free Zone Company Formation Process (2025)

- Consultation & Activity Selection:

- Define your business activity (see Meydan Activity List).

- Document Preparation:

- Passport, passport photo, proof of address, business plan (if required).

- Online Application:

- Submit details and upload documents via the Meydan Portal.

- Payment:

- Pay license and package fees online.

- License Issuance:

- Receive digital license (typically within 1 day).

- Visa Processing (if required):

- Apply for visas (0–6 per package), complete medical and Emirates ID process.

- Corporate Bank Account Opening:

- Get support from Prolink TFS for bank introductions and onboarding.

Meydan Free Zone License Application Portal Screenshot

Meydan Free Zone License Costs and Packages

| Package Type | License Cost (AED) | Visa Allocation | Key Inclusions |

|---|---|---|---|

| Zero-Visa | 12,500 | 0 | Digital license, flexi-desk option |

| 1–2 Visa | 14,500- 20,500 | 1–2 | License + up to 2 visas |

| 3–6 Visa | 20,500 + | 3–6 | License + up to 6 visas |

| Renewal (annual) | 12,500+ | 0–6 | Audited financials required |

All prices are subject to change; government fees may vary. Multi-year packages may offer discounts—contact us for the latest offers.

→ Get an exact quote for your Meydan Free Zone Company Formation within 1 hour. Contact Prolink TFS now.

Banking Partner Insights

Meydan Free Zone companies can open accounts with leading UAE banks:

Disclaimer: Bank account approval is subject to each bank’s compliance and due diligence requirements. We will assists with introductions and documentation.

Is Meydan Free Zone Good for E-Commerce or Consulting?

Meydan is ideal for:

- E-commerce brands (including dropshipping and online retail)

- Remote consultants and digital professionals

- Tech startups and app developers

- SME traders and freelancers

The free zone’s digital-first setup, flexible packages, and wide activity list make it perfect for modern, location-independent businesses.

Meydan Free Zone Company Formation vs Mainland Company Formation

Meydan Free Zone Company Formation offers 100% foreign ownership, fast digital setup, and lower costs compared to mainland Dubai, which requires a local service agent for many activities and has higher compliance costs. However, mainland companies can trade directly with the UAE market, while free zone entities need a distributor or agent for onshore business.

Learn more about mainland vs freezone setup.

2025 Compliance, Audits & Corporate Tax

- Audit Requirement: From 2025, all Meydan companies must submit audited financial statements for license renewal, regardless of visa allocation (see official audit guidelines).

- Corporate Tax: UAE corporate tax is 9%. Meydan companies may qualify for exemption as a Qualifying Free Zone Person (QFZP) if income is from permitted activities and non-mainland transactions (Article 18 CT Law).

Common Mistakes to Avoid

- Choosing the wrong business activity—always check the Meydan Activity List.

- Incomplete documents or missing signatures.

- Delays in opening a bank account—prepare all KYC documents in advance.

- Ignoring audit and renewal requirements for 2025.

- Failing to budget for visa or renewal costs.

FAQs: Meydan Free Zone Company Formation

- Is Meydan Free Zone tax-free?No. UAE corporate tax applies (9%), but exemptions exist for Qualifying Free Zone Persons (QFZP).

- Can I upgrade to a multi-visa package later?Yes. You can upgrade your license package and visa allocation at any time.

- How fast can I get my Meydan license?As quickly as 1 business day for digital licenses.

- What documents are required?Passport, passport photo, proof of address, business plan (for some activities).

- Can I open a UAE bank account?Yes, with banks such as Wio, Mashreq, RAKBank, and Emirates NBD, subject to compliance.

- Do I need audited financials for renewal in 2025?Yes, all Meydan companies must submit audited financials for license renewal from 2025.

- Is Meydan Free Zone good for e-commerce?Yes, it’s one of the best for e-commerce and digital businesses.

- What is the minimum license cost?From AED 12,500 (subject to change; government fees may vary).

- Can I have 100% foreign ownership?Yes, Meydan allows 100% foreign ownership.

- How do I get started?Contact Prolink TFS for a free consultation and step-by-step support.

Ready to launch your Meydan Free Zone Company Formation?

- Book your free consultation or call us at +971-50 360 8939

- Fast, expert setup. Registered Meydan Channel Partner.

References & External Links

- Meydan Free Zone Official Website

- Meydan Activity List

- IFZA Free Zone

- SPC Free Zone

- DMCC

- UAE Corporate Tax Law (MoF)

- Mashreq NeoBiz

- Wio Bank

- RAKBank Business

- Emirates NBD Business Banking

Disclaimer

This guide is for informational purposes only and does not constitute legal or tax advice. Always consult with a qualified advisor or the relevant authority for the latest requirements and regulations. Information is accurate as of October 2025, but government fees and rules may change.