Dubai freezone company setup in 2025 is faster and more digital than ever.

Whether you choose Meydan, IFZA, SPC, or DMCC, this step-by-step guide shows how to start a company in Dubai free zones. Covering costs, required documents, visa options, and timelines.

This guide breaks down each step so you can start your Dubai freezone company quickly, avoid costly delays, and meet all legal requirements.

Table of Contents

Why Choose a Dubai Free Zone for Your Company Setup?

Dubai free zone company setup offers

- 100% foreign ownership.

- Streamlined digital registration.

- Access to global markets.

- Free zones like Meydan, IFZA, SPC, and DMCC are recognized for fast processing, flexible licensing, and robust business support.

- Choosing the right free zone is essential for maximizing benefits and minimizing setup time.

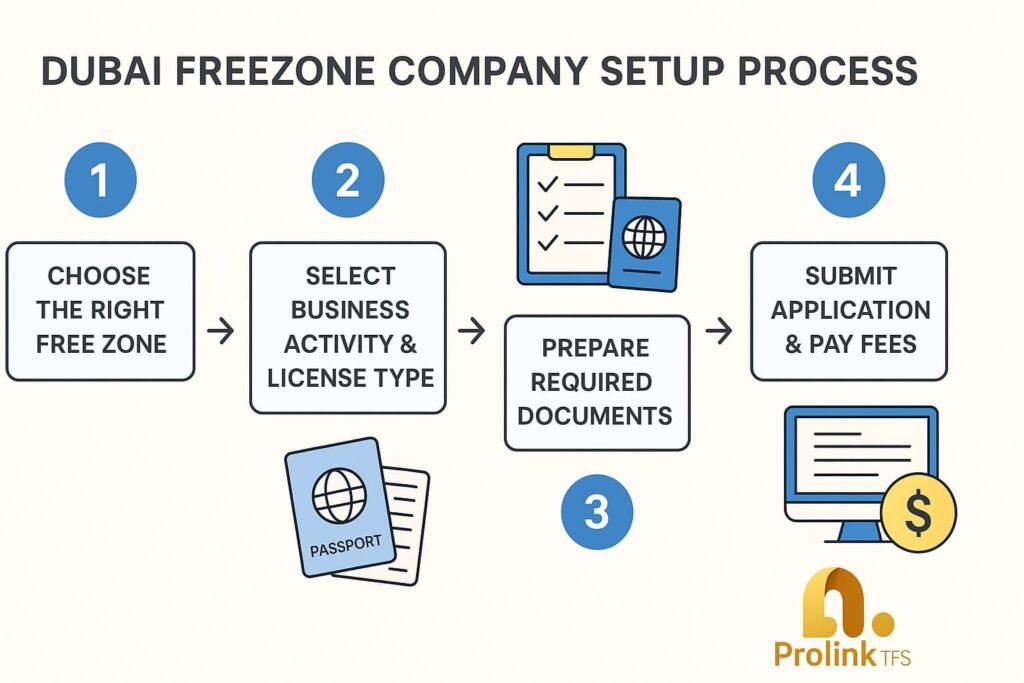

Step 1: Choose the Right Free Zone

Evaluate your business needs against the unique features of each free zone:

- Meydan: Digital-first, central Dubai location, ideal for tech, consulting, and e-commerce.

- IFZA: Flexible packages, international focus, strong support for SMEs and startups.

- SPC: Cost-effective, fast approvals, freelancer-friendly.

- DMCC: Global reputation, premium offices, best for trade and commodities.

See our Dubai free zone comparison for a detailed breakdown.

At this stage, you’ll have shortlisted the best free zone for your business goals and can proceed to select your business activity and license type.

Step 2: Select Your Business Activity & License Type

- Review the list of permitted activities in your chosen free zone.

- Decide between license types:

- Commercial: Buying and selling goods, trading, import/export.

- Professional: Services such as consulting, training, IT, or marketing.

- Industrial: Manufacturing, production, or light industrial activities.

- Some free zones allow multiple activities under one license.

At this stage, you’ll have your business activity confirmed and your license type selected—ready to move to documentation.

Step 3: Prepare Required Documents

Typical documents for Dubai free zone company registration include:

- Passport copies of shareholders and directors

- Passport-size photos

- Proof of address (utility bill or tenancy contract)

- Business plan (for certain activities)

- Completed application forms

Complete document checklist for Dubai free zone company setup

Once your documents are ready, you can proceed to submit your application and pay the relevant fees.

Step 4: Submit Application & Pay Fees

- Submit your application online or via an authorized agent.

- Pay the applicable license and registration fees.

- Some free zones offer express or VIP processing for an additional fee.

After this step, your application will be processed and you’ll be ready to receive your license and corporate documents.

Step 5: Receive Your License & Open a Corporate Bank Account

- Upon approval, receive your company license and incorporation documents.

- Visa Options: Most free zones offer Investor/Partner Visas for company owners and employees. The number and cost of visas depend on your chosen package and free zone policy.

- Bank Account: Use your company documents to open a UAE corporate bank account. Be aware: opening a bank account can take longer than the license process and may require additional compliance checks. Many free zones or agents assist with introductions to suitable banks.

Guide to opening a UAE corporate bank account

With your license and bank account in place, your Dubai freezone company setup is complete and you’re ready to start operating.

Dubai Free Zone Company Setup Cost Breakdown

| Free Zone | License Cost (AED) | Setup Time | Visa Allocation | Typical Investor Type |

|---|---|---|---|---|

| Meydan | 12,500–14,500 | 1–3 days | Up to 6 | Tech, consultants, SMEs |

| IFZA | 12,900–14,900 | 3–10 days | Up to 6 | Startups, SMEs, services |

| SPC | 9,000–12,000 | 1–3 days | Up to 6 | Freelancers, consultants |

| DMCC | From 24,000+ | 2–4 weeks | Varies | Global traders, HQs |

Meydan and SPC offer the fastest and most affordable setups, while DMCC caters to global trading firms.

Actual costs may vary by activity and package. Always confirm with your chosen free zone or consultancy firm

Common Mistakes to Avoid

- Choosing the wrong free zone for your business activity.

- Consequence: May result in license rejection or limited operations.

- Solution: Consult an expert to match your activity to the right zone.

- Submitting incomplete or incorrect documents.

- Consequence: Delays, rejections, or extra fees.

- Solution: Double-check requirements and use a checklist before submission.

- Underestimating license renewal and compliance requirements.

- Consequence: Risk of fines or business suspension.

- Solution: Set calendar reminders and work with a compliance partner.

- Delaying visa applications for staff or partners.

- Consequence: Can halt operations and incur late fees.

- Solution: Start visa applications as soon as the license is approved.

FAQs: Dubai Freezone Company Setup

Q1: How to open company in Dubai free zone?

A: Choose your preferred free zone, select your business activity, prepare documents, submit your application, pay fees, and receive your license.

Q2: What are the main steps for Dubai free zone company registration?

A: The main steps are: select a free zone, pick your business activity, gather documents, apply and pay, then receive your license and open a bank account.

Q3: What documents are needed for Dubai free zone company setup?

A: Typically, passport copies, photos, proof of address, application forms, and sometimes a business plan.

Q4: How much does Dubai free zone company setup cost?

A: Costs range from AED 9,000 (SPC) to AED 24,000+ (DMCC), depending on the zone and package.

Q5: How long does Dubai free zone company formation process take?

A: Setup can take as little as 1–3 days (Meydan, SPC) or up to 2–4 weeks (DMCC).

Q6: Do I need a local sponsor for Dubai free zone company setup?

A: No. Dubai free zones allow 100% foreign ownership for all company types and activities.

Q7: Can I work from outside the UAE with a Dubai free zone license?

A: Yes, most free zones allow remote operation, though physical presence may be required for visa or banking purposes.

Get Expert Help from Prolink TFS

Start your Dubai Free Zone company the right way.

Get a clear cost breakdown, expert setup guidance, and end-to-end support from Prolink TFS.

References & Internal Links

- Dubai Free Zone Comparison

- Meydan Free Zone Guide

- IFZA Free Zone Guide

- SPC Free Zone Guide

- DMCC Free Zone Overview

- Business Setup in Dubai Pillar

Disclaimer

This guide is for informational purposes only. Regulations and fees may change. Always consult an expert or the relevant authority for up-to-date guidance.