Table of Contents

Dubai: Where Dreams Meet Opportunity

Are you ready to take your business to new heights? Imagine a place where cutting-edge infrastructure meets tax-friendly policies, where East meets West, and where innovation thrives. Welcome to Dubai, the global business hub that’s captivating entrepreneurs from around the world. But with so many options and regulations, setting up shop in this dazzling emirate can seem daunting. Where do you start? Which business zone is right for you? How do you navigate the legal landscape?

Fear not, aspiring business owners! Whether you’re eyeing the bustling mainland or the specialized free zones, our comprehensive guide will walk you through every step of establishing your business in Dubai. From choosing the perfect license to understanding the nuances of different operational zones, we’ve got you covered. Get ready to unlock the secrets of business success in one of the world’s most dynamic cities.

In this step-by-step guide, we’ll explore everything from understanding Dubai’s business zones and choosing the right license, to navigating regulations and tapping into industry-specific opportunities. So, buckle up as we embark on this exciting journey to turn your entrepreneurial dreams into reality in the jewel of the UAE!

Understanding Dubai’s Business Zones

A. Mainland: Benefits and Requirements

Dubai’s mainland offers businesses the opportunity to operate anywhere in the UAE. Key benefits include:

- Full ownership rights for UAE and GCC nationals

- Ability to conduct business throughout the UAE

- No restrictions on the number of visas issued

Requirements for setting up a mainland business:

- Obtain initial approval from the Department of Economic Development (DED)

- Choose a local sponsor (for foreign investors)

- Secure necessary licenses and permits

- Rent office space in Dubai

B. Free Zones: Advantages and Limitations

Dubai’s free zones provide specialized economic areas with unique regulations. Advantages include:

- 100% foreign ownership

- Tax exemptions

- Simplified business processes

| Free Zone | Industry Focus | Notable Features |

|---|---|---|

| Jebel Ali Free Zone | Trading, Services | Large seaport operations |

| Dubai Multi Commodities Centre (DMCC) | Commodities | High retention rate |

| Dubai International Financial Centre (DIFC) | Finance | Significant GDP contribution |

Limitations:

- Restricted to operating within the free zone

- May require additional approvals for mainland business activities

C. Offshore: Opportunities and Restrictions

Offshore companies in Dubai offer:

- Asset protection

- Tax benefits

- Privacy for owners

However, offshore entities face restrictions:

- Cannot conduct business within the UAE

- Limited to specific activities like holding assets or intellectual property

With this understanding of Dubai’s business zones, the next crucial step is choosing the right business license. This decision will significantly impact your company’s operations and growth potential in Dubai’s dynamic business landscape.

Choosing the Right Business License

Now that we have covered Dubai’s business zones, let’s delve into choosing the right business license for your venture. Selecting the appropriate license is crucial for legally operating your business in Dubai.

A. Commercial License

A commercial license is essential for businesses engaged in trading activities, including import and export of goods. This license covers a wide range of industries such as:

- Gold trading

- Automobile industry

- Chemical sector

Commercial licenses are ideal for companies dealing with physical products and commodities. They provide the legal framework necessary for buying, selling, and distributing goods within Dubai and internationally.

B. Industrial License

Industrial licenses are tailored for manufacturing and production-based businesses. While the reference content doesn’t provide specific details about industrial licenses, they are typically required for:

- Factories

- Assembly plants

- Production facilities

These licenses ensure compliance with Dubai’s industrial regulations and standards, allowing companies to engage in manufacturing activities legally.

C. Professional License

Professional licenses are designed for businesses offering expert consultancy and service-based activities. This category includes:

| Sector | Examples |

|---|---|

| IT | Software development, cybersecurity |

| Management | Business consulting, project management |

| Marketing | Digital marketing, brand strategy |

Professional licenses are crucial for individuals or companies providing specialized knowledge and skills rather than physical products.

When choosing a business license, consider the following factors:

- Nature of your business activities

- Location of operation (Mainland, Free Zone, or Offshore)

- Ownership structure (100% foreign ownership in Free Zones)

- Cost implications (ranging from AED 5,750 to AED 30,000)

- Validity period (typically two years, with annual renewal options)

It’s important to note that the Department of Economic Development (DED) issues licenses for mainland businesses, while Free Zone authorities handle licenses for their respective zones.

With the right business license in hand, you’ll be well-prepared to navigate the next crucial steps in setting up your business in Dubai. The following section will guide you through the process of establishing your company, ensuring you meet all legal requirements and capitalize on Dubai’s thriving business environment.

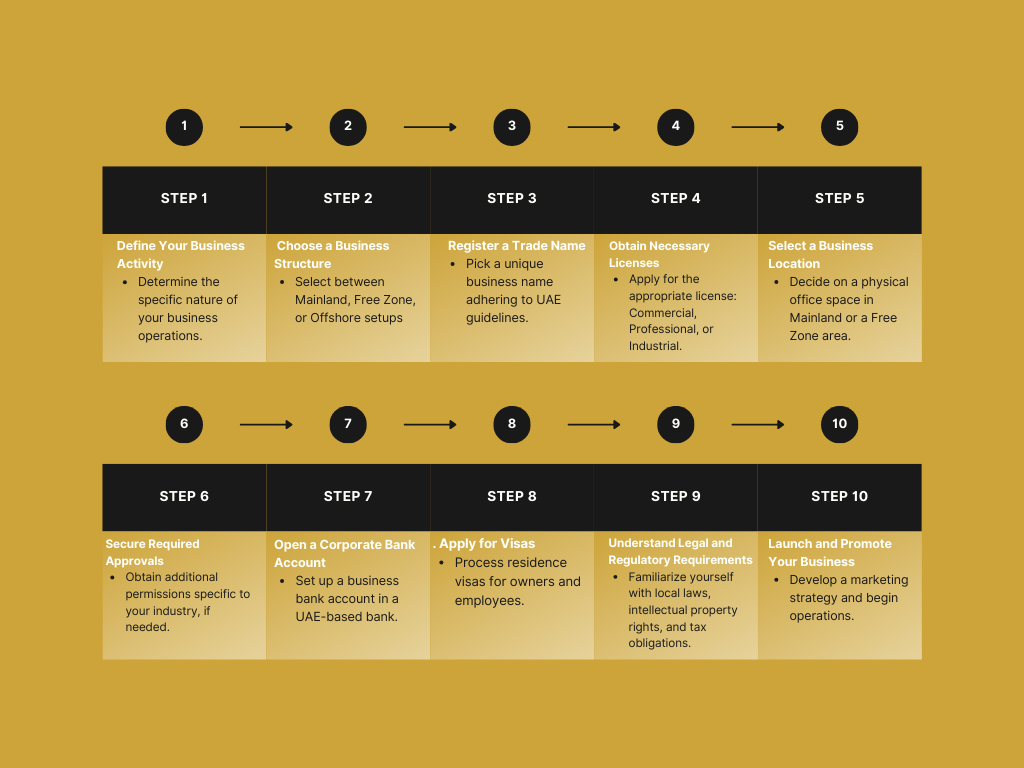

Steps to Set Up a Business in Dubai

Now that we’ve covered choosing the right business license, let’s delve into the step-by-step process of setting up your business in Dubai.

A. Determine Business Activity

Before proceeding with your business setup, it’s crucial to identify your specific business activity. This decision will influence the type of license you require. Dubai offers six main categories of business activities:

- Industrial

- Commercial

- Professional

- Tourism

- Agricultural

- Occupational

Selecting the appropriate category ensures compliance with local regulations and sets the foundation for your business operations.

B. Select Appropriate Zone

Dubai offers three main operational zones, each with distinct advantages:

| Zone Type | Benefits | Considerations |

|---|---|---|

| Mainland | Direct trade within UAE and internationally | More comprehensive compliance requirements, including Emiratisation initiatives |

| Free Zone | 100% foreign ownership, favorable tax environment | Cannot trade directly with local market |

| Offshore | Full foreign ownership, high confidentiality | Cannot engage in business within UAE |

Choose the zone that aligns best with your business objectives and operational requirements.

C. Choose Company Name

Selecting a compliant company name is a critical step. Ensure your chosen name:

- Distinguishes your business

- Complies with specific regulations

- Does not violate public morals

- Is not already registered

D. Obtain Initial Approval

Secure initial approval from the Dubai Department of Economic Development (DED). This step allows you to progress but does not authorize business operations yet.

E. Open Corporate Bank Account

With initial approval in hand, you can proceed to open a corporate bank account, which is essential for managing your business finances in Dubai.

F. Secure Office Location

A physical business location is mandatory in Dubai. Ensure your chosen space adheres to local regulations and zoning requirements.

G. Apply for Final Approval

Submit all necessary documentation, including:

- Initial approval receipt

- Attested lease agreement

- Other required permits based on your business activity

Pay for your trade license within 30 days to avoid application cancellation.

With these steps completed, you’ll be ready to start your business operations in Dubai. As we move forward, we’ll explore the various legal structures available for business setup in Dubai, which will help you make informed decisions about your company’s legal framework.

Legal Structures for Business Setup in Dubai

Now that we have covered the steps to set up a business in Dubai, let’s explore the various legal structures available for businesses in the emirate. Understanding these structures is crucial for entrepreneurs and investors looking to establish their presence in Dubai’s dynamic business landscape.

A. Limited Liability Company (LLC)

The Limited Liability Company (LLC) is one of the most popular legal structures for businesses in Dubai. Here are the key features of an LLC:

- Requires 2 to 50 shareholders

- Liability is limited to shareholders’ shares

- Traditionally required a local partner to hold 51% of the shares

- Cannot engage in professional activities unless related to banking, insurance, or investment

Recent reforms have made LLCs more attractive to foreign investors:

| Aspect | Traditional LLC | Reformed LLC |

|---|---|---|

| Foreign Ownership | Limited to 49% | Up to 100% in certain cases |

| Local Partner | Required | Not always necessary |

| Liability Protection | Yes | Yes |

B. Sole Proprietorship

For individual entrepreneurs, a sole proprietorship offers:

- Full control and management by one individual

- Personal liability for all debts

- Limited to UAE and GCC nationals for commercial activities

- Consultancy firms require specific qualifications

C. Branch Office

A branch office is an extension of a foreign company and:

- Operates as a regional branch of a parent company

- Is not a separate legal entity

- Can promote the parent company’s products or services

- May have limitations on conducting business directly

For professionals like doctors and lawyers, there’s also the option of a Civil Company, which allows partnerships among individuals of any nationality but may require a local service agent if no UAE or GCC nationals are involved.

With these legal structures in mind, the next section will delve into the key differences between Free Zone and Mainland setups, providing further insight into choosing the right business structure for your venture in Dubai.

Free Zone vs. Mainland: Key Differences

Now that we’ve explored the legal structures for business setup in Dubai, let’s delve into the key differences between Free Zone and Mainland setups, which play a crucial role in determining your business operations and potential.

A. Ownership Structure

Free Zone companies offer 100% foreign ownership, allowing international entrepreneurs complete control over their businesses. In contrast, Mainland companies traditionally required a UAE national to hold at least 51% of shares, ensuring local control. However, recent changes have relaxed this requirement for specific activities, allowing more flexibility for foreign investors in certain sectors.

B. Market Access

| Aspect | Free Zone | Mainland |

|---|---|---|

| Operational Area | Limited to free zone or abroad | Unrestricted throughout UAE |

| Local Market Access | Requires local agent | Direct access |

| Government Contracts | Limited | Can bid directly |

Mainland companies enjoy broader operational flexibility, enabling direct trading with the UAE market and government entities without geographical restrictions. Free Zone companies, while benefiting from special economic areas, face limitations on conducting business outside their designated zones.

C. Tax Implications

Free Zone companies typically benefit from significant tax advantages:

- Exemptions from corporate tax

- Zero import and export duties

- Profit repatriation allowed

Mainland companies, however, are subject to:

- 9% corporate tax on profits above AED 375,000

- VAT obligations

- Potential import/export duties

D. Regulatory Requirements

The regulatory landscape differs significantly between these two business setups:

- Free Zone Companies:

- Governed by Free Zone Authorities

- Streamlined licensing process

- May require specific certifications

- Limited visa issuance based on zone regulations

- Mainland Companies:

- Overseen by Department of Economic Development (DED)

- More complex setup and maintenance processes

- Approvals required from multiple government bodies

- Mandatory financial audits

- Less restricted visa issuance, dependent on workspace size

With these key differences in mind, next, we’ll explore Dubai’s Free Zones and the industry-specific opportunities they offer, providing further insight into the strategic advantages of choosing a Free Zone setup for certain business types.

Dubai’s Free Zones: Industry-Specific Opportunities

Now that we’ve explored the key differences between Free Zones and Mainland setups, let’s delve into the industry-specific opportunities offered by Dubai’s Free Zones.

A. Technology and Innovation Zones

Dubai’s commitment to fostering innovation is evident in its technology-focused Free Zones. These areas provide tailored environments for tech companies to thrive:

- Dubai South: Focuses on emerging technologies like Artificial Intelligence

- Dubai CommerCity: The first e-commerce Free Zone in the region

- Dubai Internet City: Hub for IT and telecommunications companies

These zones offer state-of-the-art infrastructure and networking opportunities, making them ideal for startups and established tech firms alike.

B. Finance and Trading Zones

Dubai’s strategic location as a global trade hub is reflected in its finance and trading-oriented Free Zones:

| Free Zone | Focus Area |

|---|---|

| Dubai World Trade Centre | Innovation and finance |

| Dubai Maritime City | Marine sector support |

| Jebel Ali Free Zone | International trade and logistics |

These zones provide businesses with 100% foreign ownership, tax exemptions, and full profit repatriation, making them attractive for international financial institutions and trading companies.

C. Media and Creative Zones

For businesses in the creative and media industries, Dubai offers specialized Free Zones that cater to their unique needs:

- Dubai Design District: Focuses on art and fashion

- Dubai Media City: Hub for media and broadcasting companies

- Dubai Production City: Supports printing and publishing industries

These zones not only provide the necessary infrastructure but also foster a creative environment that encourages collaboration and innovation within their respective industries.

Each of these industry-specific Free Zones operates under its own regulatory authority, simplifying compliance and operational procedures for businesses. This tailored approach allows companies to benefit from industry-specific advantages while enjoying the general benefits of Free Zone operation, such as expedited setup processes and flexible office solutions.

With an understanding of these industry-specific opportunities, we’ll next explore the financial considerations for business setup in Dubai, which are crucial for making informed decisions about where to establish your company.

Financial Considerations for Business Setup

Now that we’ve explored Dubai’s Free Zones and their industry-specific opportunities, let’s delve into the financial considerations for setting up a business in Dubai.

Initial Capital Requirements

Business setup in Dubai requires careful financial planning. The initial capital requirements vary depending on the chosen business zone and structure:

- Minimum share capital: Ranges from AED 1,000 to AED 1,000,000

- Average minimum share capital: Around AED 50,000

Free zones often have lower capital requirements compared to mainland businesses. For instance:

| Business Zone | Minimum Capital Requirement |

|---|---|

| DMCC Free Zone | Starting from AED 50,000 |

| Other Free Zones | Can be as low as AED 1,000 |

Taxation and Corporate Taxes

Dubai’s tax environment is one of its most attractive features for businesses:

- No personal income tax

- No corporate tax for most business activities in free zones

- Value-added tax (VAT) introduced in 2018 at a rate of 5%

Banking and Financial Services

Dubai offers a robust banking and financial services sector to support businesses:

- Business account opening: Required for company registration

- Financial guarantees: Necessary for employee visas in free zones

- Tailored business packages: Available from institutions like DMCC

For example, DMCC offers:

- Basic Biz Package: AED 35,484

- Jump Start Package: For startups and SMEs

These packages often include:

- Application fees

- Registration costs

- Annual license fees

- Co-working space options

With these financial considerations in mind, next, we’ll explore navigating Dubai’s business regulations, which are crucial for ensuring compliance and smooth operations in this thriving business hub.

Navigating Dubai’s Business Regulations

Now that we’ve covered the financial considerations for setting up a business in Dubai, let’s delve into the crucial aspect of navigating Dubai’s business regulations. Understanding and complying with these regulations is essential for the smooth operation of your business in this dynamic emirate.

Emiratisation Requirements

Emiratisation is a key focus in Dubai’s business landscape. While the reference content doesn’t provide specific details on Emiratisation, it’s important to note that businesses operating in Dubai must be aware of and comply with any Emiratisation quotas or requirements set by the government to promote employment opportunities for UAE nationals.

Compliance with Local Laws

Adhering to local laws is paramount for businesses in Dubai. Here are some critical compliance areas:

- Anti-corruption laws

- Data protection regulations

- Anti-money laundering (AML) and counter-terrorism financing (CFT) measures

- VAT registration and compliance

- Economic Substance Regulations (ESR)

- Ultimate Beneficial Ownership (UBO) reporting

Key Compliance Requirements

| Requirement | Description | Penalty for Non-Compliance |

|---|---|---|

| VAT Registration | Mandatory for businesses with taxable supplies exceeding AED 375,000 | Not specified |

| AML/CFT Measures | Registration with goAML platform and reporting suspicious transactions | Up to AED 5 million |

| UBO Register | Identify individuals or entities controlling over 25% of share capital | Not specified |

| Financial Audits | Mandatory for mainland companies, varies for free zones | Not specified |

Documentation and Submissions

Proper documentation and timely submissions are crucial for maintaining compliance:

- VAT returns: Submit according to the prescribed schedule

- Financial audits: Mainland companies must conduct audits, but submission to authorities is not required

- ESR notifications and reports: Submit based on the company’s financial year

- UBO register: Maintain and update as necessary

- AML/CFT reports: Submit suspicious transaction reports through the goAML platform

It’s important to note that compliance requirements may vary depending on whether your business is set up in a free zone or on the mainland. Free zone companies may have different audit submission timelines set by their governing bodies.

With this understanding of Dubai’s business regulations, we’ll next explore the support services available for business setup, which can greatly assist in navigating these complex requirements and ensuring compliance.

Support Services for Business Setup

Now that we’ve navigated Dubai’s business regulations, let’s explore the support services available for business setup in Dubai.

Government Resources

Dubai’s government offers extensive resources to support entrepreneurs and businesses:

- Department of Economy & Tourism (DET): Provides guidance on company registration, trade names, and licensing.

- Ministry of Human Resources and Emiratisation (MOHRE): Oversees labor laws and employment regulations.

- Dubai Future District: An initiative aimed at fostering a dynamic digital economy.

These government bodies ensure compliance with local laws and facilitate smooth business operations.

Business Consultancy Services

Professional consultancy services play a crucial role in business setup:

| Service | Description |

|---|---|

| Company Formation | Assistance with legal requirements and incorporation process |

| Licensing | Guidance on obtaining appropriate business licenses |

| Visa Services | Support for entrepreneur and employee visa applications |

| PRO Services | Handling administrative tasks related to licenses and visas |

| Tax and VAT Management | Financial guidance from qualified accountants |

| Office Space Recommendations | Assistance in finding suitable workspaces |

Companies like Prolink TFS offer comprehensive support, allowing entrepreneurs to focus on core business functions while optimizing time and costs.

DMCC Business Rewards Program

The Dubai Multi Commodities Centre (DMCC) free zone offers a Business Rewards Program, providing:

- Industry-specific opportunities

- Networking events

- Access to state-of-the-art facilities

- Potential collaborations with other businesses in the zone

This program exemplifies Dubai’s commitment to fostering a thriving business ecosystem across various sectors, including technology, finance, and media.

With these support services in place, entrepreneurs are well-equipped to establish and grow their businesses in Dubai. As we transition to discussing living and working in Dubai, it’s clear that the city’s infrastructure extends beyond business support to create an attractive environment for expatriates and professionals alike.

Living and Working in Dubai

Now that we have covered the support services available for business setup in Dubai, let’s delve into the aspects of living and working in this vibrant global hub.

Quality of Life and Amenities

Dubai offers an exceptional quality of life, characterized by:

- World-class infrastructure

- Low crime rates

- Tax-free income (personal income tax)

- Vibrant expat community (over 80% of the population)

- Diverse food scene and entertainment options

The city boasts numerous amenities that cater to a luxurious lifestyle:

- High-end real estate options (e.g., Burj Khalifa, Dubai Mall)

- Luxury shopping experiences

- Indoor skiing facilities

- Yacht parties and bottomless brunches

However, it’s important to note that this lifestyle comes with a high cost of living, particularly in terms of housing and education.

Residential Options in Business Districts

Dubai offers a range of residential options in its business districts:

| Neighborhood | Features | Average Rent (Annual) |

|---|---|---|

| Downtown | Amenities, nightlife | $1,000 – $8,000 |

| Palm Jumeirah | Luxury, beachfront | $1,000 – $8,000 |

Property ownership is accessible to foreigners, with residency possible through real estate investments exceeding AED 750,000. The Golden Visa program has simplified residency qualifications for certain investors and professionals.

Work-Life Balance in a Global Hub

Maintaining work-life balance in Dubai can be challenging due to:

- High costs associated with social activities

- Dubai’s vibrant social scene and luxurious lifestyle can influence spending habits, so it’s important for newcomers to manage their finances responsibly.

However, Dubai offers several advantages for professionals:

- Opportunities for career growth in various thriving sectors

- Attractive salaries in high-demand professions

- Excellent global connectivity through Dubai International Airport

- Numerous co-working spaces for remote workers

- High-quality healthcare facilities with mandatory medical coverage

It’s crucial to note that while Dubai presents compelling opportunities, expatriates should be mindful of:

- Cultural adjustments and respect for local customs

- Extreme summer heat from May to September

- Recent introduction of a 9% corporate tax rate

- Currently, the UAE does not offer a broad pathway to citizenship for expatriates, though long-term residency options like the Golden Visa offer stability and security.

To thrive in Dubai’s work environment, professionals should balance the allure of luxury experiences with responsible financial management, as the culture of affluence can lead to unexpected financial strain.

Setting up a business in Dubai offers immense opportunities for entrepreneurs and investors alike. With its strategic location, robust infrastructure, and business-friendly environment, Dubai provides an ideal backdrop for various industries to thrive. From understanding the different business zones and choosing the right license to navigating regulations and exploring free zone opportunities, this guide has outlined the essential steps to establish your venture in this dynamic city.

As you embark on your business journey in Dubai, remember that thorough planning and professional guidance can significantly streamline the process. Whether you opt for a mainland setup or a free zone company, Dubai’s diverse ecosystem caters to a wide range of business needs. With the right approach and support, you can turn your entrepreneurial vision into reality in one of the world’s leading business hubs. Take the first step today and explore the endless possibilities that Dubai has to offer for your business growth and success.

Frequently Asked Question on Business Setup in Dubai?

1. What is the typical duration to establish a business in Dubai?

The time required to set up a business in Dubai varies based on the chosen business activity and legal structure. It can range from a few days to several weeks.

2. Is full foreign ownership of a business permitted in Dubai?

Yes, many free zones in Dubai allow 100% foreign ownership. Additionally, recent regulations permit full foreign ownership in specific mainland sectors.

3. What is the minimum capital investment needed to start a business in Dubai?

The required capital investment depends on the business type and jurisdiction. Some free zones offer cost-effective packages suitable for startups and small enterprises.

4. Is a local sponsor necessary for establishing a business?

Not always. While certain mainland businesses may require a local partner, many free zones allow businesses to operate without the need for a local sponsor.

5. What types of business licenses are available in Dubai?

Dubai offers various licenses, including:

Commercial License: For trading activities.

Professional License: For service-oriented businesses.

Industrial License: For manufacturing and industrial operations.

More Resources:

Pingback:Business Setup in Dubai for South African Entrepreneurs: A Step-by-Step Guide - Your Trusted Partner for Business

The positivity and optimism conveyed in this blog never fails to uplift my spirits Thank you for spreading joy and positivity in the world

This post truly brightened my day! I appreciate how you delve into the topic with such positivity and clarity. It’s refreshing to see content that not only informs but also uplifts the reader. Your writing style is engaging and always leaves me feeling inspired. Keep up the fantastic work!