Thinking about launching a business in Dubai in 2025? Whether you’re a solopreneur, SME, or global investor, this guide walks you through every crucial step jurisdictions, licenses, costs, consultants, and more. Let’s set your business up for success in the UAE’s thriving economy. We’ll guide you through every step to ensure your setup aligns with your business needs and goals.

Dubai and the UAE remain a top destination for company formation, thanks to favorable regulations, an expanding free zone ecosystem, and a strategic gateway connecting global markets.

1. Why Business Setup in Dubai Still Shines in 2025

Dubai is a powerhouse for entrepreneurs aiming to conduct business in the UAE. With over 40 free zone companies, flexible regulations, and robust infrastructure, it continues to lead regional and international business.

Dubai’s Tax Advantages & Global Tax Reform

- 0% corporate tax for profits under AED 375,000

- 15% corporate tax for large multinational firms per OECD requirements

- No personal income tax, no capital gains tax, and full repatriation of profits

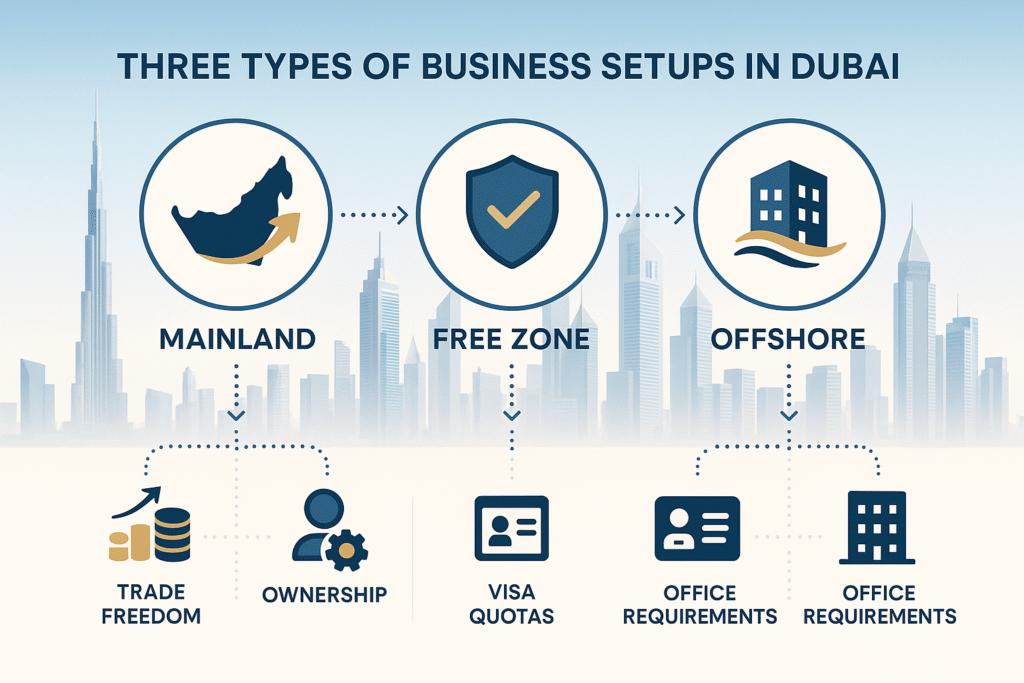

Mainland, Free Zones & Offshore: Dubai Offers It All Dubai mainland companies allow unrestricted trade within the UAE, while free zones support a wide range of business activities with incentives like:

- 100% foreign ownership

- No import/export duties within zones

- Fast-tracked company registration

Offshore jurisdictions, though limited in business operations, help protect assets and support international holdings.

2. Mainland vs Free Zone vs Offshore: Understanding the Type of Business & Jurisdiction

When You Need a Local Partner Though most sectors now allow 100% foreign ownership for mainland companies, certain strategically sensitive activities, such as those in oil & gas, banking, insurance, and defense, may still require a UAE national partner or specific regulatory approvals. It’s crucial to align your company formation with these compliance standards.

Choosing the Right Structure for Your Business

| Legal Structure | Suitable For |

|---|---|

| LLC (Limited Liability Company) | General trading, service, and retail sectors |

| Branch Office | Foreign companies expanding to the UAE |

| Sole Proprietorship | Professionals (consultants, designers) |

Export to Sheets

Comparing Mainland, Free Zone & Offshore

| Feature | Mainland | Free Zone | Offshore |

|---|---|---|---|

| Ownership | Up to 100% | 100% | 100% |

| Trade Within UAE | Yes | Limited (via distributor) | No |

| Visa Quota | Flexible | Limited by package | Not applicable |

| Office Requirement | Mandatory | Optional (flexi-desk) | None |

| Setup Speed | Moderate | Fast | Fast |

| Typical Use | Broad scope | Sector-specific firms | Holding structures |

Export to Sheets

3. Company Formation in Dubai: Step-by-Step Guide

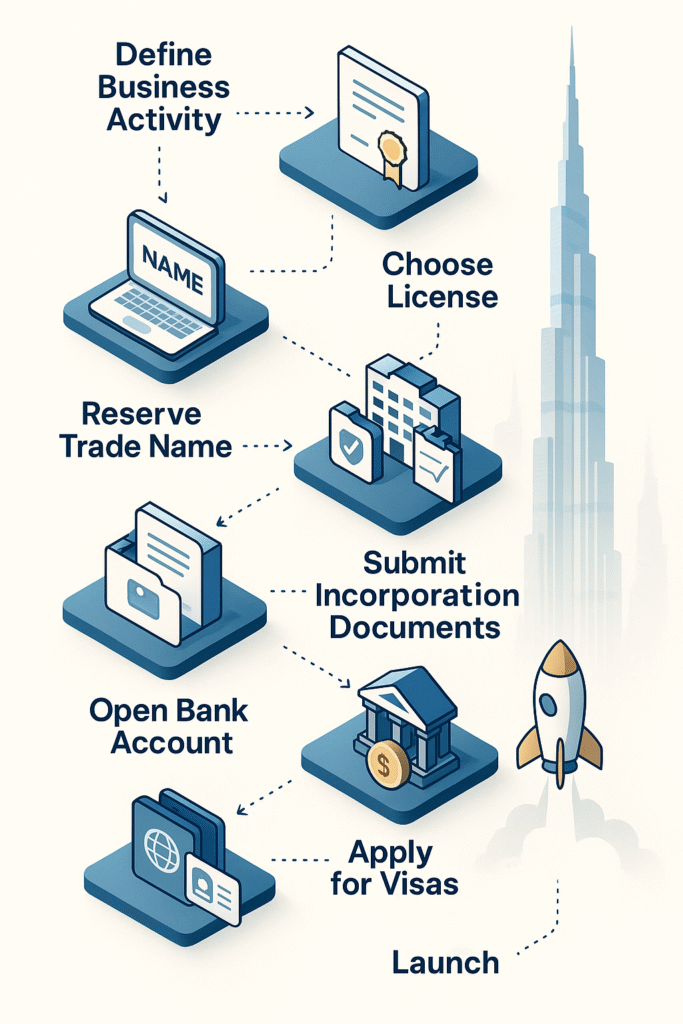

The entire company formation process has become more efficient in 2025. Here’s how to set up your business in Dubai efficiently:

- Define the Nature of Your Business Know your exact business activity whether it’s consultancy, general trading, or digital services. Your activity defines the license required and impacts approvals.

- Choose the Right License in Dubai

- Commercial License – for trade or retail

- Professional License – for consultants, educators, creatives

- Industrial License – for manufacturing & production

- Reserve Your Company Name Must comply with UAE naming rules (no offensive terms, must reflect business activity, etc.)

- Secure a Premises (Office or Flexi-Desk)

- Mainland: Mandatory office lease

- Free Zone: Flexi-desk and shared workspace options

- Submit Incorporation Documents MoA, shareholder details, lease agreement Pay setup and license fees

- Open a Corporate Bank Account in Dubai Common banks: Emirates NBD, RAKBank, Mashreq, FAB Requirements: trade license, company documents, passport copies

- Apply for UAE Residency Visas Investor visas, employee visas Biometric, medical test, Emirates ID

This smooth and efficient business setup process is made easier by working with trusted business setup consultants in Dubai.

4. Business Setup Costs in Dubai in 2025: How Much Does Business Setup Cost?

| Component | Mainland (AED) | Free Zone (AED) |

|---|---|---|

| Trade License | 10,000–15,000 | 5,000–12,000 |

| Office or Flexi-Desk | 10,000–50,000 | 0–15,000 |

| Visa Fees (per person) | 3,000–6,000 | 3,000–6,000 |

| Bank Account Setup | Free–1,500 | Free–1,500 |

| Pro Services/Consultants | 5,000–10,000 | 3,000–7,000 |

Total Expected Cost: AED 20,000 to AED 50,000+, depending on your company formation structure and office setup.

5. Business Setup Consultants in Dubai: Why You Should Consider One

Business setup services in Dubai help guide entrepreneurs and foreign companies through licensing, visas, and banking. Consultants ensure you:

- Avoid compliance errors

- Choose the right company formation in the UAE

- Align with your business goals and future scalability

Prolink TFS is one of the top business setup experts in Dubai and the UAE mainland. Whether you’re looking to set up your business in Dubai or need advice on business expansion outside the UAE, our consultants in Dubai offer efficient solutions tailored to your needs.

6. Key Opportunities & Trends: Business in Dubai and the UAE

High-Growth Sectors

- FinTech, blockchain, crypto-regulated exchanges

- Green technology & sustainability ventures

- Digital marketing & software development startups

Free Zone Business Setup for Global Entrepreneurs Popular zones: IFZA, DMCC, Meydan Free Zone, RAKEZ Sector-specific licensing, 100% foreign ownership, and tax benefits Dubai offers diverse opportunities and a wide range of business activities to accommodate startups, SMEs, and global enterprises.

7. Final Checklist to Set Up Your Business

✅ Identify your business activity

✅ Choose your jurisdiction (mainland, free zone, offshore)

✅ Reserve trade name and secure approvals

✅ Finalize office space or flexi-desk

✅ Submit MoA and incorporation documents

✅ Open corporate bank account in the UAE

✅ Apply for visa(s) and Emirates ID

✅ Launch and focus on growing your business

8. Types of Licenses in Dubai Explained

Before setting up a business, it’s essential to understand the different types of licenses available in Dubai. These licenses define the nature of your business and the activities you’re legally allowed to conduct.

- Commercial License Issued to businesses engaged in trading activities buying and selling goods, import/export, logistics, and general trading companies. This is the most common license for retail and e-commerce businesses.

- Professional License Ideal for individuals and companies providing intellectual or professional services such as consultancy, education, marketing, design, and legal services. These licenses allow 100% ownership for expatriates in many sectors.

- Industrial License Required for businesses involved in manufacturing, production, or industrial operations. Additional approvals from the UAE Ministry of Industry may be required.

- Specialized Licenses

- eTrader License: Issued by the Dubai Department of Economic Development for home-based businesses selling products online.

- Tourism License: For agencies offering travel, tour operations, and hospitality-related services.

- Dual License: Available in certain free zones, a dual license allows a free zone company to also obtain a mainland license. This can be beneficial for businesses looking to expand their market reach, though specific conditions and limitations on direct mainland trading may apply depending on the free zone and activity. It generally offers more operational flexibility by eliminating the need to set up two separate legal entities.

Choosing the correct type of license is critical to ensuring compliance with UAE laws and aligning with your long-term business strategy.

9. Opening a Corporate Bank Account in the UAE

Opening a business bank account in the UAE is a required step once your trade license is issued. UAE banks are highly reputable and offer various packages for startups, SMEs, and large enterprises.

Documents Required

- Trade license copy

- Passport copies of shareholders and directors

- Emirates ID and residence visa (if available)

- Memorandum of Association (MoA)

- Company stamp

- Lease agreement or office Ejari

- Ultimate Beneficial Owner (UBO) declaration

Popular Banks for Business Accounts

- Emirates NBD: Strong digital services and SME focus

- Mashreq Bank: Fast onboarding with solid online banking tools

- RAKBank: Affordable options for startups

- ADIB / FAB: Preferred for companies with UAE nationals

Tips for Approval

- Keep your business activity transparent

- Maintain proper accounting records

- Work with a business setup consultant to avoid delays or rejections

Some banks now allow virtual onboarding, especially for free zone companies, which speeds up the process and minimizes paperwork.

10. In-Depth Comparison: Dubai Mainland vs Free Zone Setup

Making the right jurisdictional choice is critical for operational freedom, cost control, and future growth.

Dubai Mainland Pros:

- Can conduct business anywhere in the UAE

- No restrictions on client base or commercial location

- Flexible visa quotas based on office space Cons:

- Office space mandatory

- Government interaction required (DED, ministries)

Free Zone Pros:

- 100% foreign ownership

- Easy setup with packages including office and visas

- No import/export duties within the free zone Cons:

- Limited ability to trade directly in the UAE mainland without a distributor

- Visa quotas tied to office package

| Feature | Mainland | Free Zone |

|---|---|---|

| Ownership | Up to 100% | 100% |

| Local Market Access | Unrestricted | Limited |

| Visa Flexibility | High | Capped |

| Government Interaction | Direct (DED) | Handled by Free Zone |

| Office Requirement | Yes | Optional |

If you’re planning to open a retail shop, restaurant, or logistics hub, the mainland is ideal. For digital businesses, e-commerce, or consultancies, free zones offer speed and simplicity.

11. Visa & Employee Entry into the UAE

Once your business is registered, you’ll need to sponsor yourself and/or your team for residence visas.

Types of Visas

- Investor/Partner Visa: For shareholders and business owners

- Employment Visa: For staff hired under the company

- Golden Visa: For long-term residency (5 or 10 years), available to investors (e.g., real estate, public investment), skilled professionals, and exceptional talent meeting specific criteria.

Visa Issuance Process

- Apply for an Establishment Card

- Get the entry permit

- Complete a medical fitness test

- Register for Emirates ID and biometrics

- Finalize visa stamping on passport

Each free zone has its own visa quota system. In the mainland, visa allocation is more flexible and based on office space. Hiring a business setup consultant helps ensure your employee’s entry into the UAE is fast and compliant.

12. Key Compliance Considerations Beyond Setup

While business setup in Dubai is increasingly streamlined, entrepreneurs must also be aware of ongoing compliance requirements to ensure long-term success.

- Economic Substance Regulations (ESR): With the introduction of corporate tax, the UAE has integrated economic substance requirements into its tax framework. While dedicated ESR reporting has largely been phased out for financial years ending after December 31, 2022, businesses are still expected to demonstrate genuine economic activity in the UAE to comply with global tax transparency standards. Your chosen business setup consultant can guide you on maintaining the necessary substance for compliance under the new tax regime.

- Anti-Money Laundering (AML) & Combating the Financing of Terrorism (CFT): Businesses in Dubai must adhere to stringent AML/CFT regulations. This includes robust Customer Due Diligence (CDD), Ultimate Beneficial Ownership (UBO) declarations, comprehensive record-keeping, and reporting suspicious transactions via platforms like goAML. Non-compliance can lead to significant fines and penalties. Reputable business setup consultants can assist in establishing the necessary AML frameworks.

- Intellectual Property (IP) Protection: For businesses built on innovation, protecting intellectual property like trademarks, patents, and copyrights is crucial. The UAE has a robust legal framework for IP protection, administered by the Ministry of Economy. Registering your IP in the UAE safeguards your brand and inventions against unauthorized use and infringement.

13. Common Challenges After Setup

While the setup process is becoming more efficient, businesses may encounter various challenges post-launch. Being prepared can help mitigate these:

- Market Competition: Dubai is a highly competitive market, requiring strong marketing, differentiation strategies, and continuous innovation to stand out.

- Employee Management & Labor Laws: Navigating the local labor laws (e.g., gratuity, dismissal, working hours) and managing a multicultural workforce requires careful attention and cultural sensitivity.

- Continuous Regulatory Updates: Staying informed about evolving regulations, especially in dynamic sectors like FinTech or real estate, is essential for ongoing compliance.

- Banking Relations: Maintaining transparent financial practices and good relationships with banks is crucial for smooth operations, especially regarding ongoing compliance with AML/KYC requirements.

- Finding the Right Talent: While Dubai attracts global talent, identifying and retaining skilled employees who fit your company culture can be a challenge.

14. FAQ’s (People Also Ask)

How much does business setup in Dubai cost in 2025?

Expect AED 20,000–50,000 depending on license, space, and visa needs.

Can I start a business in Dubai from abroad?

Yes, remote setup and e-signature services make it easier than ever.

What is the best jurisdiction for company formation in Dubai?

It depends on the type of business, target market, and licensing needs.

What is a limited liability company (LLC) in the UAE?

An LLC offers liability protection and is a common structure for businesses in the UAE.

Is opening a bank account in Dubai difficult?

With the right documentation, consultants streamline the process for foreign founders.

15. Set Up Your Business in Dubai with Prolink TFS

Whether you’re exploring company setup in Dubai mainland or considering free zone companies, Prolink provides a smooth and efficient business setup experience. Our business consultants will provide you the necessary support throughout the UAE.

👉 Schedule a free consultation at ProlinkTFS and take the next step toward your UAE business journey.